For individuals stepping into the the realm of side motor trading, grasping the intricacies of automobile ownership regulations is essential. The part-time motor trade policy presents unique obstacles and possibilities for individuals seeking to earn additional income by the buying and trading of vehicles. This guide aims to illuminate the key rules and optimal approaches that govern vehicle ownership in this context, ensuring participants can function within the law while maximizing their profits.

Maneuvering through the complications of vehicle ownership can be daunting, especially when juggling a full-time job with a part-time motor trade. Comprehending the legal requirements and duties tied to vehicle ownership, such as registration, insurance, and tax responsibilities, is essential for achievement in this industry. By mastering these elements, aspiring motor traders can establish a firm foundation for their business and avoid prospective pitfalls that could obstruct their progress.

Grasping Part-time Vehicle Trade Policies

Part-time automobile trade policies are created for individuals who participate in buying and selling automobiles on a part-time basis. These policies recognize that not all automobile dealers operate as full-time businesses, allowing versatility while guaranteeing adequate coverage. For part time traders, individuals still need to adhere to specific laws concerning the ownership of vehicles, especially in terms of insurance and enrollment.

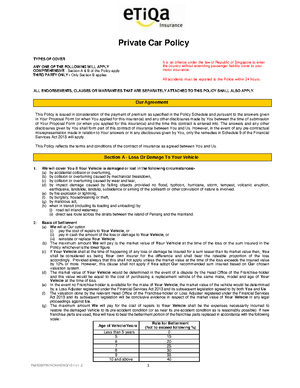

One key aspect of part-time motor trade regulations is the customized insurance options they give. Unlike standard standard personal insurance, these policies usually cover vehicles intended for sale, ensuring that the trader is insulated while the cars are in their care. This might include protection during transit and while the automobiles are shown for sale. Grasping the specifics of this insurance is vital for avoiding gaps that could result in economic loss.

Furthermore, part-time automobile dealers need to stay in compliance with local laws about vehicle ownership and selling. This often involves comprehending the requirements for registering cars, making sure they meet safety standards, and maintaining accurate logs of sales. Following rules not only protects the trader but also improves trustworthiness in the marketplace, building trust with potential buyers.

Essential Aspects for Vehicle Owners

When engaging in seasonal motor trading, it is important for vehicle owners to be aware of the legal implications of their activities. This includes getting themselves with local regulations concerning buying and selling vehicles, and ensuring compliance with tax obligations. Each jurisdiction may have different requirements, and noncompliance can lead to hefty fines or legal complications. Therefore, staying informed about the specific laws governing motor trade practices is critical for a successful operation.

Another notable aspect to keep in mind is the insurance coverage associated with part-time motor trading. Traditional vehicle insurance policies may not properly cover the risks involved in trading. Owners should look into options tailored to motor traders that provide the essential protection against potential liabilities. It is advisable to consult with an insurance professional who can assist vehicle owners on the optimal policy options based on their trading activities and frequency.

Additionally, keeping records plays a significant role in handling a part-time motor trade policy. Vehicle owners should maintain thorough records of all transactions, including transaction agreements, to ensure clarity and accountability. This practice not only helps in managing finances but also provides necessary documentation in case of disputes or audits. Being organized and diligent with record-keeping can substantially enhance a vehicle owner's ability to navigate the intricacies of the part-time motor trade.

Steering Legal and Financial Responsibilities

Owning and controlling a vehicle under a occasional motor trade policy requires a thorough knowledge of the regulatory requirements that accompany trading vehicles. One of the key responsibilities is confirming that all vehicles are adequately registered and insured for trade purposes. This entails obtaining the necessary documents that reflect your status as a part-time motor trader, as personal insurance policies may not cover commercial practices. Familiarize yourself with the local regulations surrounding motor trading to avoid potential regulatory issues.

In furthermore to legal compliance, managing financial responsibilities is vital for occasional motor traders. Keeping accurate records of acquisitions, movements, and any costs related to your trading endeavors is essential. This will also help you keep tabs on your gains and losses but also ensure that you can provide appropriate documentation for tax purposes. Contemplate consulting on a part time motor trade policy does it matter who owns the vehicles? or financial advisor who understands the nuances of motor trading to help you steer through the financial landscape successfully.

Lastly, it is essential to remain informed about any updates in guidelines or insurance policies that could affect your temporary motor trading operations. Regularly reviewing trade policies and insurance coverage can stop costly oversights. Being forward-thinking about your responsibilities not just fosters trust with your buyers but also reinforces your position in the vehicle ownership landscape. Staying educated will allow you to make knowledgeable decisions, ultimately improving your success as a temporary motor trader.